The integration of AI Automated Trading into the financial markets has revolutionized the way trades are executed, analyzed, and optimized.

With advancements in machine learning and neural networks, trading has become faster, smarter, and more efficient. Gone are the days when human traders manually sifted through mountains of data to identify potential trades.

Today, AI trading systems powered by automated trading algorithms make those decisions in milliseconds, analyzing vast quantities of data to predict market movements and execute trades at optimal prices.

At the heart of this technological transformation is the ability of AI-driven stock trading systems to learn from historical data, adapt to changing market conditions, and predict future trends with remarkable accuracy.

AI trading bots, utilizing predictive analytics in finance, are designed to make decisions with minimal human intervention, thus offering unparalleled scalability and precision.

As industries embrace the AI trading revolution, the implementation of these intelligent systems at an industrial scale presents both vast opportunities and unique challenges.

Understanding how to design, integrate, and scale these systems is key for any financial institution or investor looking to gain a competitive edge.

This blog explores the steps necessary to implement AI automated trading at an industrial scale, the technologies that power these systems, and the real-world impact they are having on financial markets.

Key Takeaways

- AI trading systems automate and optimize trading decisions for higher efficiency and accuracy.

- Machine learning and neural networks in trading play a crucial role in predictive analytics and real-time market analysis.

- AI investment trading offers scalability and the potential for high-frequency trading with lower risks.

- Successful implementation requires high-quality data, regulatory compliance, and robust backtesting strategies.

- AI trading bots and automated trading algorithms are reshaping financial markets, making them more data-driven and accessible.

The Rise of AI Automated Trading

Over the past two decades, AI trading systems have evolved from simple rule-based systems to highly sophisticated algorithms capable of executing complex strategies in real-time. Initially, algorithmic trading relied on static formulas and basic technical indicators.

Today, machine learning models are able to learn from vast amounts of data and adjust strategies dynamically, offering a huge competitive advantage in the fast-paced world of trading.

The real game-changer, however, is the ability of AI-driven stock trading platforms to predict price movements, optimize trading strategies, and adapt to changing market conditions without human intervention.

Intelligent trading systems are now capable of processing and analyzing high-frequency trading data, enabling them to make split-second decisions that would be impossible for human traders.

AI Trading Algorithms: The Core of Automated Trading Systems

At the core of automated trading is the AI trading algorithm, a sophisticated set of mathematical rules that guide the decision-making process.

These algorithms analyze data, identify patterns, and execute trades based on pre-defined criteria.

Unlike traditional trading systems that rely on human decision-making, AI trading bots are designed to operate autonomously, reducing the risk of emotional or psychological biases.

The implementation of machine learning techniques in algorithmic trading has opened new avenues for financial market prediction.

Understanding AI Trading Systems

What is AI-driven stock trading?

AI-driven stock trading refers to the use of advanced algorithms powered by machine learning to analyze market data and execute trades without human intervention.

These systems can process vast amounts of data, identify trading opportunities, and make real-time decisions based on market trends.

Key Components of Automated Trading Bots

AI trading bots are designed to perform specific tasks autonomously. Key components include:

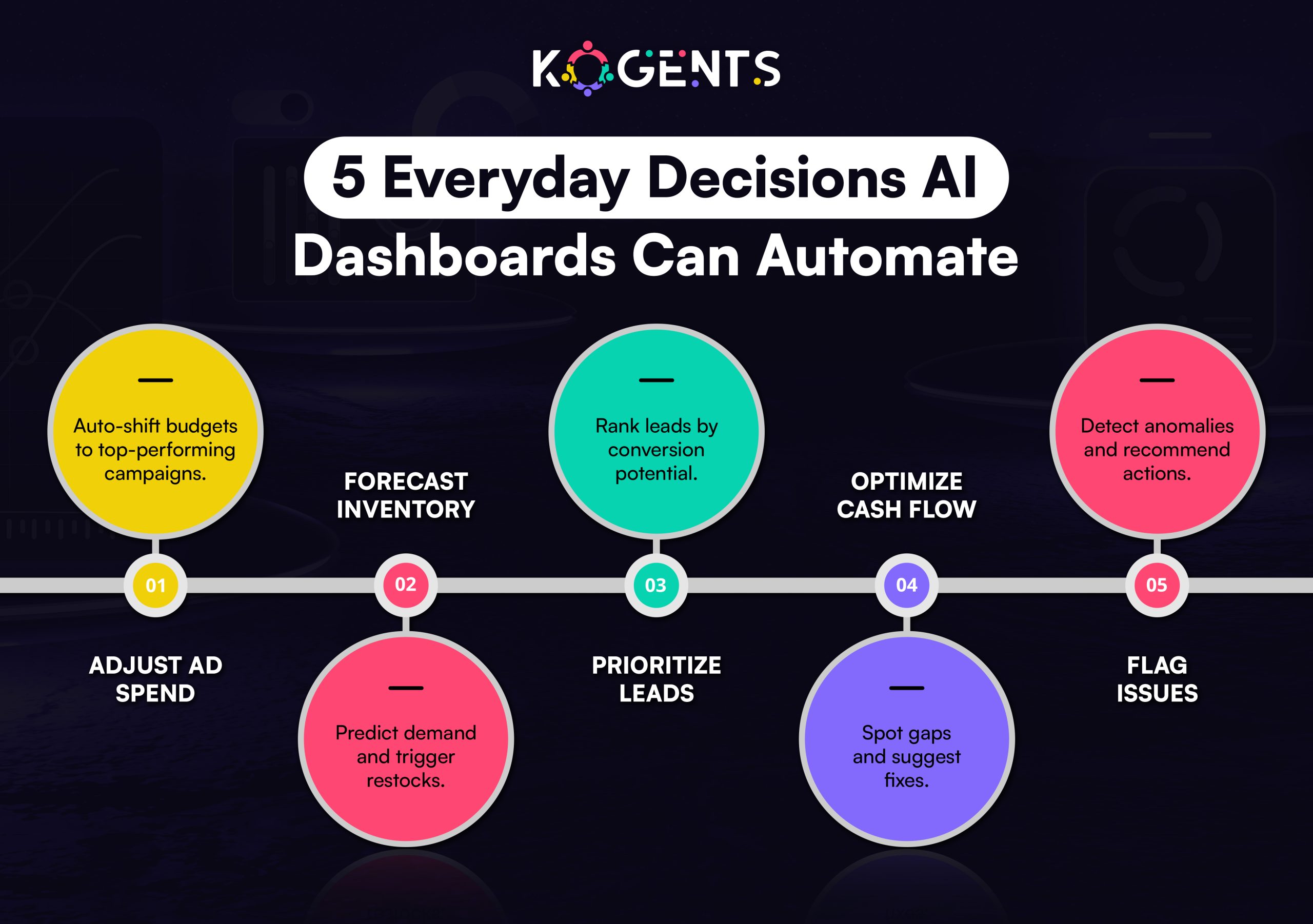

- Market Data Analysis: AI bots process market data to identify trends, volatility, and other factors that affect trading decisions, often displayed through a custom AI agent dashboard for better monitoring and actionable insights.

- Risk Management: AI algorithms are programmed to assess and mitigate risks by setting stop-loss levels, diversifying portfolios, and using other risk management techniques.

- Execution Engine: Once a trading signal is identified, the bot executes trades automatically, ensuring timely and efficient execution.

- Adaptive Learning: Machine learning allows the bot to adapt to changing market conditions by learning from previous trades and market movements.

Types of Machine Learning Automated Trading Strategies

- Supervised Learning: The algorithm is trained using historical data with known outcomes.

- Unsupervised Learning: The AI learns from unlabelled data to find patterns and clusters.

- Reinforcement Learning: AI learns by trial and error, optimizing its performance over time based on rewards and penalties.

Neural Networks in Trading

Neural networks are a subset of deep learning algorithms that mimic the human brain’s structure.

These networks are particularly effective in recognizing patterns in financial data and making predictions about future price movements.

Designing the AI Automated Trading System

Strategic Planning for Industrial-Scale AI Implementation

Building an AI automated trading system at an industrial scale requires strategic planning, including:

- Data Infrastructure: Establishing a robust data pipeline for real-time market data.

- Algorithm Design: Selecting and designing trading strategies that align with business goals.

- Testing and Optimization: Backtesting trading strategies using historical data to fine-tune performance.

Structuring Data Pipelines for Real-Time Market Analysis

- Real-time analysis is crucial for high-frequency trading.

- Data pipelines must be able to handle vast amounts of data from multiple sources, process it quickly, and provide actionable insights for trading decisions.

Predictive Analytics in Finance and Trading Strategies

- Predictive analytics allows AI systems to forecast price movements based on historical patterns and market conditions.

- Integrating these analytics with machine learning algorithms can lead to more accurate predictions and better trading decisions.

Stock Market Automation Using Intelligent Trading Systems

- Automating the stock market with intelligent trading systems requires integrating AI algorithms with market infrastructure.

- This includes leveraging predictive models and real-time analysis to make data-driven trading decisions.

Key AI Trading Techniques and Technologies

Machine Learning Techniques

- Supervised Learning: Used for predicting market movements based on historical data.

- Unsupervised Learning: Helps detect anomalies or hidden patterns that might signal profitable opportunities.

- Reinforcement Learning: Optimizes strategies by continuously learning from trade performance.

Natural Language Processing (NLP) in Trading

- NLP allows AI to process textual information, including news articles, financial reports, and social media posts.

- By understanding market sentiment, AI trading bots can make decisions based on sentiment analysis.

Backtesting Trading Strategies

- Before deploying a strategy, AI systems undergo rigorous backtesting on historical data.

- This ensures that the strategy performs as expected under different market conditions and helps refine the model.

Case Studies

Renaissance Technologies

Renaissance Technologies is a prime example of AI trading at an industrial scale. By using quantitative trading systems and sophisticated AI trading algorithms, they have achieved exceptional returns by automating trading across various asset classes.

Two Sigma Investments

Two Sigma uses advanced machine learning techniques and intelligent trading systems to process vast amounts of data and predict market movements with remarkable accuracy.

Their approach demonstrates the power of AI in optimizing trading strategies and delivering better outcomes.

QuantConnect

QuantConnect provides a platform that empowers developers and institutions to build and backtest their AI trading algorithms.

The platform leverages machine learning and data-driven strategies to help users develop scalable trading models.

Challenges of Implementing AI Automated Trading at an Industrial Scale

- High Development Costs: The infrastructure, data, and expertise required to build AI trading bots can be expensive.

- Data Quality: AI models are only as good as the data they are trained on, making data accuracy essential for success.

- Regulatory Compliance: Financial markets are highly regulated, and AI systems must comply with these regulations to avoid legal issues.

Market Manipulation Risks: The potential for algorithmic manipulation exists, requiring robust monitoring systems.

Challenges of Implementing AI Automated Trading

| Challenge | Description | Possible Solution |

| Data Quality | Inaccurate or incomplete data | Implement strict data validation |

| Regulatory Compliance | Complex legal frameworks | Regular audits and explainable AI |

| High Development Costs | Infrastructure and data expenses | Use scalable cloud platforms |

| Market Manipulation Risks | Algorithmic misuse | Real-time monitoring systems |

Conclusion

The integration of AI automated trading systems represents the future of finance. With the ability to process vast amounts of data and execute trades in real time, these systems offer immense potential for improving market efficiency, reducing human error, and generating higher returns.

However, implementing AI trading at an industrial scale comes with its own set of challenges, including data quality, regulatory compliance, and risk management.

By adopting a strategic approach and collaborating with Kogents.ai, AI automation companies and financial enterprises can unlock the full potential of machine learning in trading, neural networks, and predictive analytics to stay ahead of the curve and gain a competitive advantage.

FAQs

What is AI automated trading?

AI automated trading uses machine learning algorithms and AI trading bots to execute trades without human intervention. These systems analyze market data, identify trading opportunities, and place trades automatically.

How does AI work in automated trading?

AI in automated trading uses neural networks and predictive analytics to make decisions based on market data. It learns from historical data, adjusts strategies in real-time, and executes trades accordingly.

What are the benefits of AI in stock market trading?

AI offers numerous benefits, including faster decision-making, the ability to analyze vast amounts of data, and predictive analytics in finance to optimize trading strategies and improve profitability.

How do AI trading algorithms predict stock prices?

AI trading algorithms analyze historical price data, identify patterns, and apply statistical models to forecast future price movements. Deep learning techniques enhance this process.

Are AI trading bots effective for high-frequency trading?

Yes, AI trading bots are highly effective in high-frequency trading, as they can process and analyze data in real time, making trading decisions within fractions of a second.

How can AI improve risk management in automated trading?

AI can significantly enhance risk management in automated trading by using advanced algorithms to continuously monitor market conditions and adjust positions in real time. Machine learning models can predict potential risks and automatically implement strategies like stop-loss orders, portfolio diversification, and hedging to minimize losses.

What is the role of backtesting in AI automated trading?

Backtesting is essential in AI automated trading as it allows traders to evaluate the performance of their AI trading algorithms on historical market data. This process helps validate the effectiveness of trading strategies and ensures they work as expected in real market conditions. AI trading bots use backtesting to fine-tune their decision-making models, optimizing them before going live with real investments.

How does AI in trading handle market volatility?

AI trading systems are specifically designed to handle market volatility by quickly processing large volumes of data and adapting to rapid market changes. Machine learning algorithms can detect patterns in market behavior and adjust strategies accordingly, making real-time decisions to mitigate risk.